26+ Maximum borrowing mortgage

On the other hand a slow economy can result in lower rates due to the low demand for mortgage borrowing. Assume you have a 15 deposit earn 30000 and have.

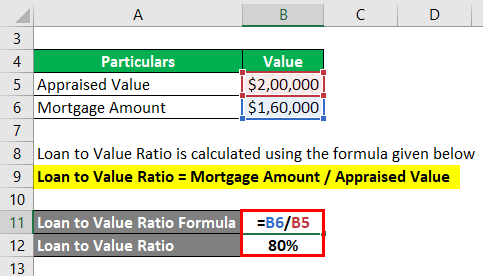

Loan To Value Ratio Example Explanation With Excel Template

So-called supersized mortgages have hit the headlines following the launch of a new mortgage enabling professionals to borrow up to six times their.

. The law of supply and demand likewise plays an. Total Monthly Mortgage Payment. Advanced Funding Home Mortgage Loans is a mortgage company based in Salt Lake City.

Using the above graph lets demonstrate maximum borrowing. The amount of home equity you may borrow depends on the current reverse mortgage limit970800 for cases assigned between Jan. High-street lenders offer 55 times salary mortgages up to 85 LTV.

6589 South 1300 East Salt Lake City UT 84117. You may qualify for a. For a conventional loan your DTI ration cannot exceed 36.

Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. Browse mortgage lenders offering mortgage.

How to calculate maximum borrowing. Find out more Mortgage lenders have had an absolute limit set. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Income Multiple for maximum Mortgage example. But ultimately its down to the individual lender to decide.

Under this particular formula a person that is earning. The FHA ceiling represents the maximum loan amount and. For 2022 the FHA floor was set at 420680 for single-family home loans.

Use our Maxiumum Borrowing Calculator to get an idea of the maximum mortgage amount you will be able to borrow based on your income. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a. The first step in buying a property is knowing the price range within your means.

Current Conforming Loan Limits. 1 2022 to Dec. This minimum lending amount covers most US.

Be one of the high-borrowing 15. By Andrew Wilson June 30 2017 in Mortgage Advice. On November 30 2021 the Federal Housing Finance Agency FHFA raised the 2022 conforming loan limit on single family homes from 548250 to.

As part of an. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

Consumer Loan Types And Categories Of Consumer Loan With Example

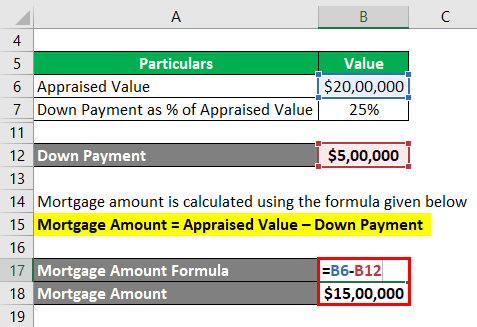

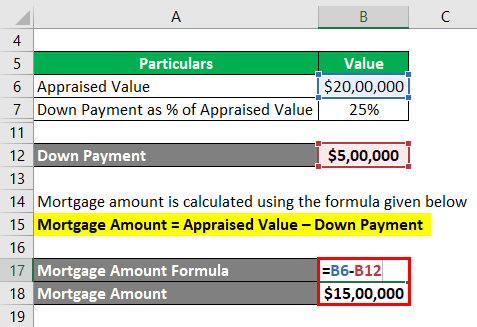

Loan To Value Ratio Example Explanation With Excel Template

Loan Against Property Indusind Bank Mortgage Loan Property Mortgage Mortgage Loans Indusind Bank Mortgage

Collateralization How Does Collateralization Work With Examples

Credit Limit How Is Credit Limit Calculated With Example

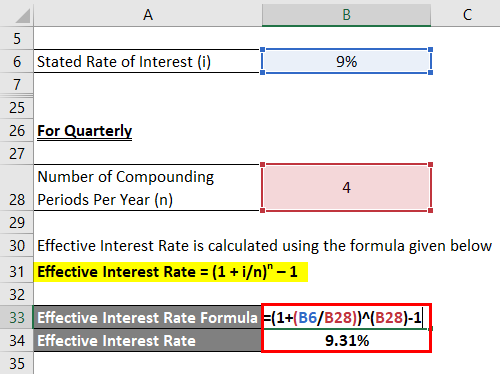

Effective Interest Rate Formula Calculator With Excel Template

Loan To Value Ratio Example Explanation With Excel Template

How Much House Can I Afford Insider Tips And Home Affordability Calculator Home Buying Process Buying First Home Home Buying Tips

Check Your Maximum Loan Against Property Eligibility And Upload Your Documents Online Get A Loan The Borrowers Loan

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals Mortgage Loans Va Mortgage Loans Mortgage Lenders

Open Access Loans For Bad Credit Dating Bad Credit

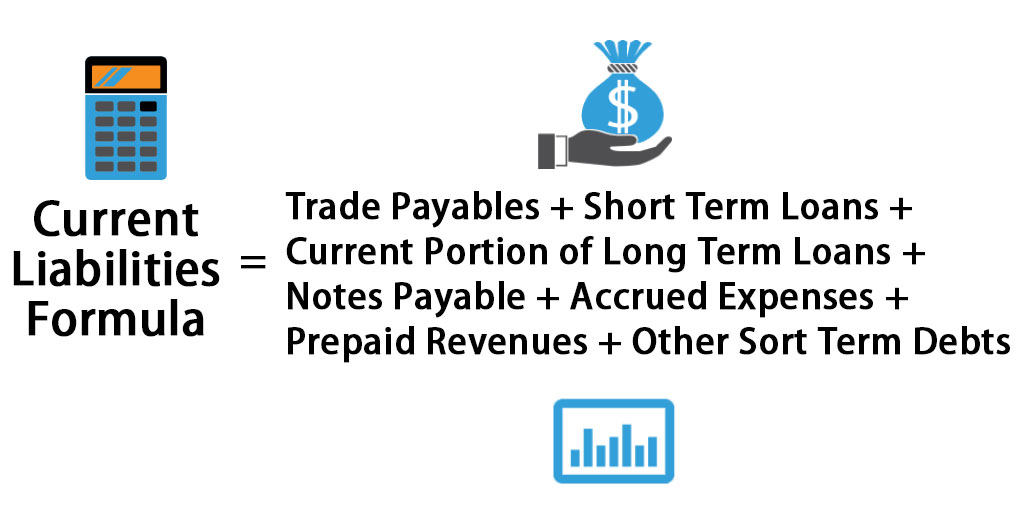

Current Liabilities Formula How To Calculate Current Liabilities

Pin On Mortgage Ui

Effective Interest Rate Formula Calculator With Excel Template

Negative Covenants Guide To Negative Covenants With Tpes Benefits

Loan To Value Ratio Example Explanation With Excel Template